34+ Extra principal payment calculator

It is possible that a calculation may result in a certain monthly payment that is not enough to repay the principal and interest on a loan. You could own your house 13 years sooner than under your current payment.

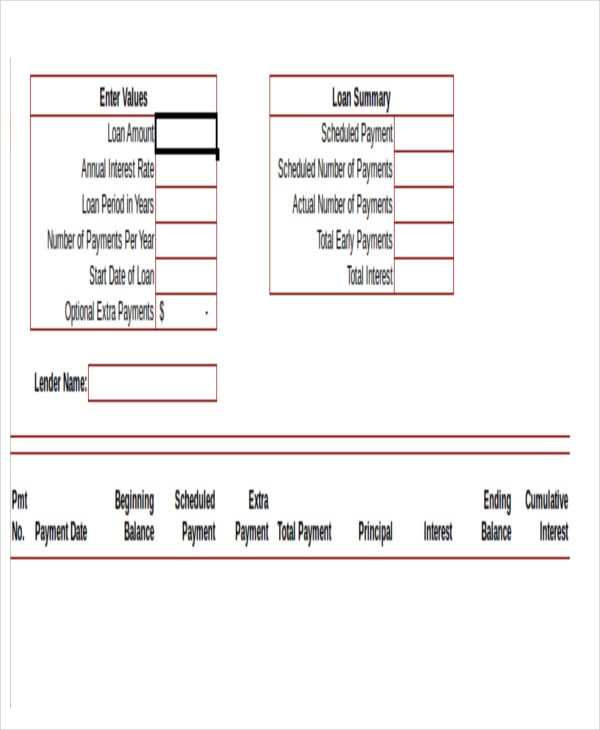

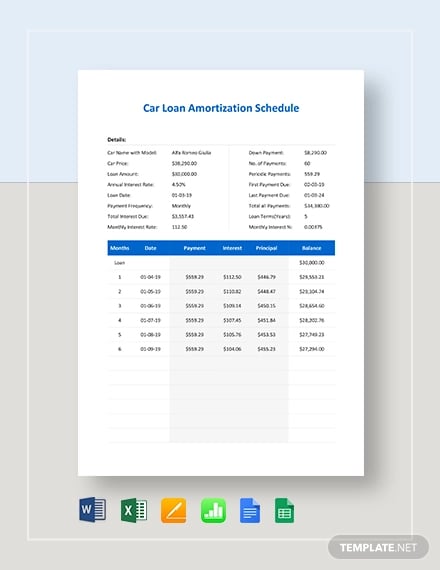

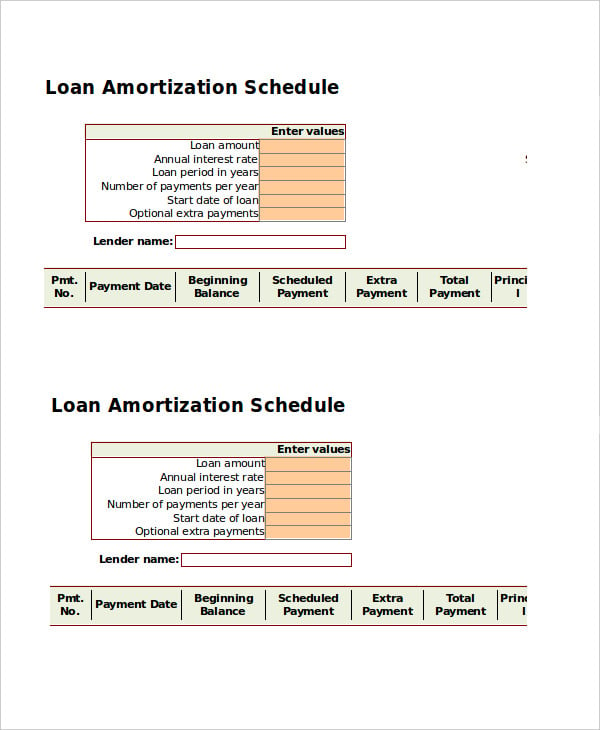

8 Car Loan Amortization Schedules Google Docs Apple Pages Ms Word Free Premium Templates

Ad Work with One of Our Specialists to Save You More Money Today.

. Principal Balance - The loan amount you borrowed. There are optional inputs in the Mortgage Calculator to include many extra payments and it can be helpful to compare the results of supplementing mortgages with or without extra payments. Use our extra payment calculator to determine how much more quickly you may be able to pay off your debt.

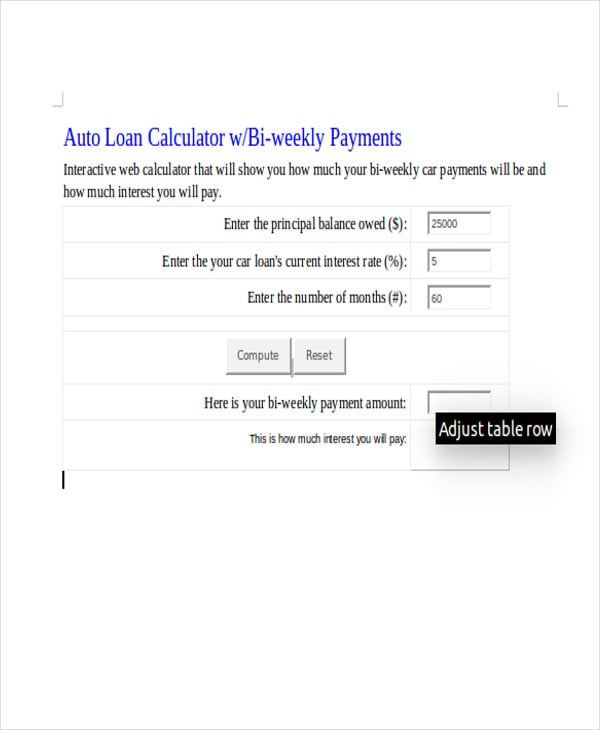

A 225000 loan amount with a 30-year term at an interest rate of 3875 with a down payment of 20 would result in an estimated. Bank Has Online Mortgage Calculators To Provide Helpful Customized Information. Biweekly paymentsThe borrower pays half the monthly payment every two weeks.

Use our extra payment calculator to determine how much more quickly you may be able to pay off your debt. Original loan balance Annual percentage rate 0 to 40 Initial term in months 30yrs360 1 to 360 Number of payments already made 0 to 999 Proposed additional monthly payment. Conforming fixed-rate estimated monthly payment and APR example.

The extra payment calculator allows you to enter the following figures. Enter your loan information and find out if it makes sense to add additional payments each month. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Make payments weekly biweekly semimonthly. With 52 weeks in a year this amounts to 26 payments or 13 months of mortgage. Use this amortization calculator to help you determine how many months it could take to pay off your loan with or without making extra payments.

Try different loan scenarios for affordability or payoff. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. Simply add the extra into the Monthly Pay section of the calculator.

Use this free calculator to figure out what your remaining principal balance home equity will be after paying on your loan for a specific number of months or years. Original loan balance Annual percentage rate 0 to 40. Loan amount total principal of the loan stated on the contract Extra payment per month how much you plan to pay extra on a monthly basis After you enter all of the figures simply press calculate.

Interest Rate - The percentage cost of the principal borrowed. The calculator will use all of the date you have entered and will display. Bank Has The Tools For Your Mortgage Questions.

Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Mortgage Calculator With Extra Payments. By making a small additional monthly payment toward principal you can greatly accelerate the term of the loan and thereby realize tremendous savings in interest payments.

Use the Extra Payments Calculator 2 to understand how making additional payments may save you money by decreasing the total amount of interest you pay over the life of your home loan. This calculator can also estimate how early a person who has some extra money at the end of each month can pay off their loan. In interest over the life of the loan.

If you want to add extra payments to your loan to pay it off quicker please use this calculator to see how quickly you will pay off your loan by making additional payments. Current monthly payment principal and interest only. Create amortization schedules for the new term and payments.

Making extra payments of 500 month could save you. Use our extra payment calculator to determine how much more quickly you may be able to pay off your debt. Use this calculator to determine 1 how extra payments can change the term of your loan or 2 how much additional you must pay each month if you want to reduce your loan term by a certain amount of time in months.

Results are based on the assumption that the original mortgage repayment period is 30 years.

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

8 Car Loan Amortization Schedules Google Docs Apple Pages Ms Word Free Premium Templates

Early Mortgage Payoff Calculator Mls Mortgage Mortgage Payoff Amortization Schedule Mortgage Refinance Calculator

Amortization Schedule Template 8 Free Word Excel Documents Download Free Premium Templates

Download Our Free Mortgage Payment Calculator With Extra Principal Payment Excel Template Input Only Fe Mortgage Payoff Free Mortgage Calculator Loan Payoff

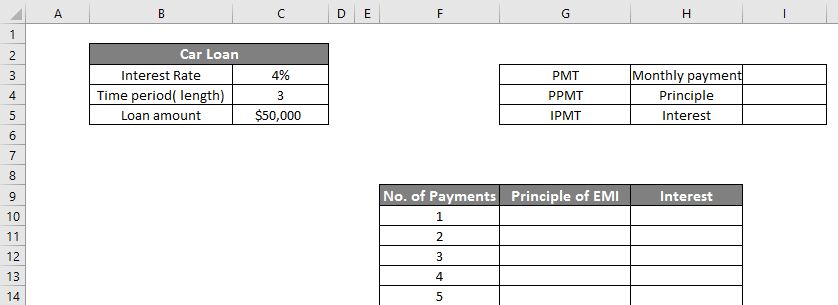

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortizatio In 2022 Mortgage Amortization Calculator Amortization Schedule Amortization Chart

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Mortgage Calculator And Amortization Table With Extra Payments Additional Principal Excel Te Pay Off Mortgage Early Mortgage Loan Calculator Mortgage Loans

8 Car Loan Amortization Schedules Google Docs Apple Pages Ms Word Free Premium Templates

Amortization Schedule Template 8 Free Word Excel Documents Download Free Premium Templates

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Loan Amortization With Extra Principal Payments Using Microsoft Excel Amortization Schedule Mortgage Amortization Calculator Money Management Advice

Amortization Schedule Template 10 Free Sample Example Format Download Free Premium Templates

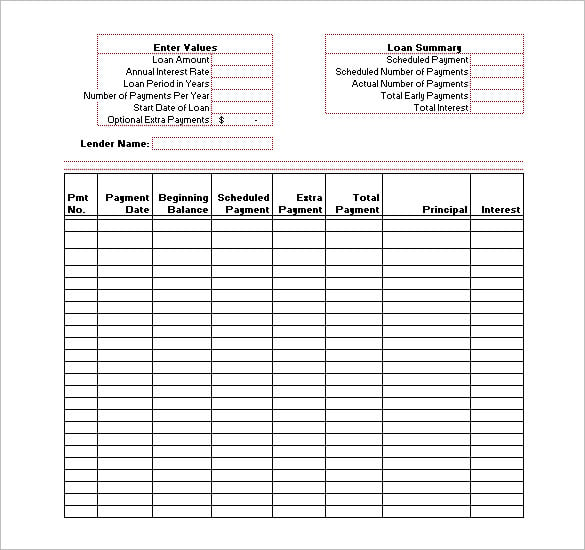

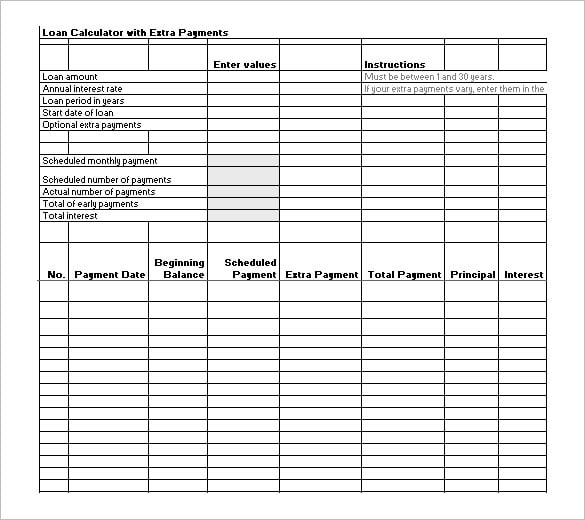

12 Loan Payment Schedule Templates Free Word Excel Pdf Format Download Free Premium Templates

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel